Choose the tax type you need to pay below.

If you've already received a bill or notice of assessment for this payment, go to bill payment options.

Individual Income Tax Return Payment Options

Payment options available to J.C. Taylor Insurance policy holders. Go to JCTaylor.com. Billing Questions. BILLING SERVICE CENTER. Monday – Friday 9AM to 8PM ET Automated Phone System: 24/7. Foremost Pay Online: FAQ. Below are some frequently asked questions about Foremost Pay Online. Electronic billing and payment options are available to MassMutual customers for their convenience. Enroll in eBill, ePay or set up auto pay today. Payment Options. Paying your electric bill should be simple. That’s why MID offers many convenient ways for you to pay your bill. Make a payment by credit or debit card or check your balance by phone FREE of charge. Payments made after 5pm will. Payment Options and our acquiring partners offer 360-all-integrated, globally connected yet locally coordinated payment processing services for businesses of all sizes. Trust us with all your digital payments. Pay with credit card, debit card, PayPal, Venmo or Amazon Pay You can pay online using your credit card, debit card, PayPal, Venmo or Amazon Pay. Our payment processing vendor Paymentus will charge a convenience fee of $1.75 per transaction.

Use these options if you're paying after you've filed your return. You can also pay at the time of filing through approved electronic filing options, and schedule your payment for any day up to the May 1 filing deadline.

Online, directly from your bank account (free)

- Log into your online services account.

- Don’t have an account? Create one now.

Not ready to create an account?

You can pay using eForms.

- Individual return payment: 760PMT eForm

- Qualifying farmers, fishermen, and merchant seamen: 760PFF eForm

Credit or debit card (additional fee)

Make a return payment (choose 'Individual Tax Return Payments') through Paymentus. A service fee is added to each payment you make with your card.

Check or money order

Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to:

Virginia Department of Taxation

P.O. Box 1478

Richmond, VA 23218-1478

Include your Social Security number and the tax period for the payment on the check.

Qualifying farmers, fishermen, and merchant seamen should use the 760-PFF voucher.

Note: If you filed a paper return with your local Commissioner, mail the voucher and check to the same place you sent your return and make the check payable to the local Treasurer.

Payment Fee - Returned Payments

If your financial institution does not honor your payment to us, we may impose a $35 fee (Code of Virginia § 2.2-614.1). This fee is in addition to any other penalties and interest you may owe.

Extension Payment Options

Virginia grants an automatic 6-month extension to file your taxes (November 1 for most people). However, the extension does not apply to any taxes owed. If you will be filing during the extension period, but expect to owe taxes, make an extension payment to avoid additional penalties and interest.

Online, directly from your bank account (free)

- Log into your online services account.

- Don't have an account? Create one now.

Not ready to set up an account?

- Use the individual extension payment eForm (760IP) - just fill out the form fields and have your bank routing and account numbers ready.

Check or money order

Mail the 760IP voucher with check or money order payable to Virginia Department of Taxation to:

Virginia Department of Taxation

P.O. Box 760

Richmond, VA 23218-0760

Include your Social Security number and the tax period for the payment on the check.

Payment Fee - Returned Payments

If your financial institution does not honor your payment to us, we may impose a $35 fee (Code of Virginia § 2.2-614.1). This fee is in addition to any other penalties and interest you may owe.

Estimated Tax Payment Options

Use the following options to make estimated tax payments. For more information about filing requirements and how to estimate your taxes, see Individual Estimated Tax Payments.

Online, directly from your bank account (free)

- Log into your online services account to schedule all 4 quarterly payments in advance.

- Don’t have an account? Create one now.

Not ready to create an account? Use eForms - make sure to choose the correct voucher number for the payment you're making.

- Individual estimated payment: 760ES eForm

ACH credit

Pay by ACH credit and initiate sending payments from your bank account to Virginia Tax's bank account. See our Electronic Payment Guide for details on requirements and set-up with financial institutions, which may include fees.

Credit or debit card (additional fee)

Pay using a credit or debit card through Paymentus (choose 'Individual Estimated Tax Payments'). A service fee is added to each payment you make with your card.

Check or money order

Mail the correct 760ES voucher for the tax period to:

Virginia Department of Taxation

P.O. Box 1478

Richmond, VA 23218-1478

Attach check or money order payable to Virginia Department of Taxation. Include your Social Security number and the tax period for the payment on the check.

Payment Fee - Returned Payments

If your financial institution does not honor your payment to us, we may impose a $35 fee (Code of Virginia § 2.2-614.1). This fee is in addition to any other penalties and interest you may owe.

There’s no denying that when it comes to accepting and receiving payments, PayPal is the reigning champion. In fact, it’s the de facto online payment solution for online customers, freelancers, and business owners.

While people tend to love PayPal for a variety of reasons, technology has opened the door for a number of competitors to challenge PayPal by offering cheaper frees, faster transactions, and enhanced security. Here are 15 of those alternatives.

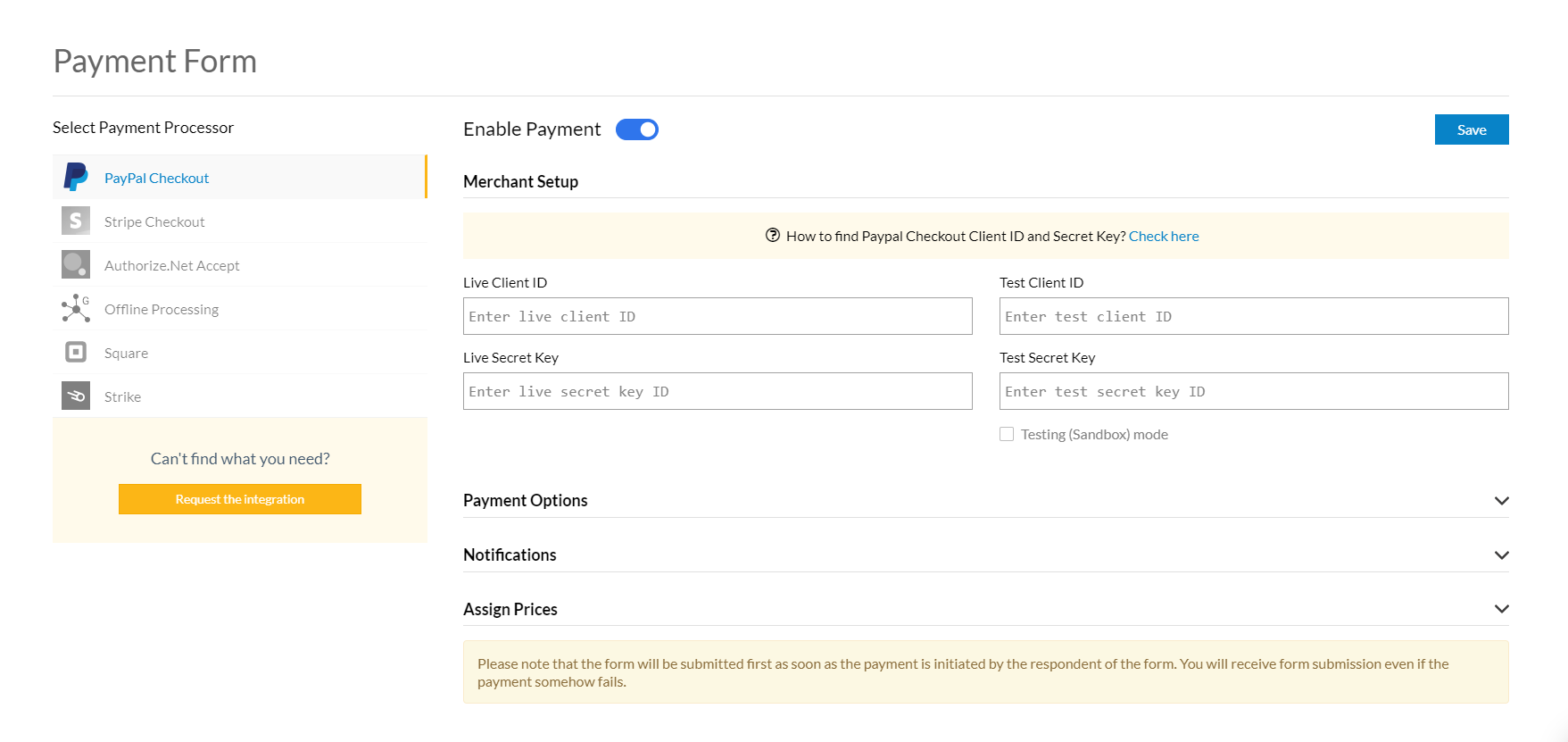

Payments Options Images

1. Due

Due made a name for itself through its innovative time-tracking and invoicing tools, which are especially useful for freelancers and small business owners. More recently, Due has allowed users to start accepting secure online payments for just a 2.7 percent transaction rate. Due also accepts global payments, which typically occur within two business days, as well as a digital wallet to send or receive money to anyone in the world instantly with little to no cost. It even has an e-bank where you can store your cash online.

2. Stripe

Stripe has fascinated users for the last couple of years with its powerful and flexible API. This means that you can tailor the platform to meet your specific needs, whether you’re running a subscription-based company or an on-demand marketplace. Stripe integrates with hundreds of other applications, so even if you’re not a professional coder, you can get up and running quickly. The lack of setup, monthly, or hidden fees is an added bonus.

3. Dwolla

Dwolla has similar features to PayPal when it comes to transferring funds, but thanks to its API, it focuses more on bank transfers, or Automated Clearing House (ACH) payments, so users can create a customized payment solution where payments are received within a day. Best of all, transactions are free.

Related: What You Need to Know About the 3 Biggest Global Payment Methods

4. Apple Pay

If you’re a merchant, then it’s time to consider accepting Apple Pay. Transactions are faster and more secure, since Apple Pay uses touch ID confirmation. In other words, a customer can use their fingerprint to pay for their takeout pizza. Apple Pay is still relatively young, but don’t be surprised if the service will adapt to support older machines. Also, word on the street is that Apple is working on a P2P payments system within iMessage.

5. Payoneer

Payoneer is one of the oldest global payment processing services. It is available in more than 200 countries and accepts 150 different currencies. Receiving payments is free, and the platform includes a flexible API that grows with your business. Like PayPal, you can receive a plastic MasterCard if you aren’t ready to go 100 percent digital.

6. 2Checkout

2Checkout is another trusted payment platform that allows users to accept credit cards, debit cards, and PayPal globally. It’s available in 87 different languages, offers advanced fraud protection, integrates with hundreds of online shopping carts, and allows you to automatically bill customers with recurring billing.

Related: Big Banks Make Online Payments Easier for Business Owners

7. Amazon Payments

If you want to give customers peace of mind, then accept payments through Amazon. Whenever they make a purchase on your site, they automatically go through Amazon’s checkout. This means that they’ll use their Amazon credentials, which makes the checkout process more convenient and trustworthy.

8. Square

Square changed the game when it introduced its magstripe reader, allowing business owners to swipe credit cards anywhere for a 2.75 percent transaction fee per swipe. However, you can also send electronic invoices, and ultimately get paid, through the Square Cash App.

Square Payment Processing

9. Payza

With this popular service, you can send or receive payments from anyone in the world in just a matter of minutes. It also has a cool and easy-to-use interface, offers a robust and unique security system, and provides dedicated support—and it’s free to sign up. What’s most interesting about Payza is that on top of receiving and withdrawing funds from a bank account and credit card, it also accepts bitcoin.

10. Skrill

Skrill has become a popular alternative to PayPal thanks to features like instant withdrawals and deposits, low transaction fees, exclusive offers, the ability to accept from 40 currencies, and being able to send text messages directly from your account. If you refer a friend, the company will put 10 percent of the fees they generate from paying or sending money into your Skrill account for an entire year.

Related: How to Cut Transaction Costs on Customer Purchases

11. Venmo

Even though PayPal acquired Venmo, the fundamental principles are different between the two. PayPal is used for making simple transactions for either personal or professional purposes. Venmo is used by individuals who consider themselves social spenders. In other words, it’s like a hybrid of PayPal and a social network like Facebook, since transactions are shared on an online feed. So whenever a friend pays back a friend, it’s shared publicly.

12. Google Wallet

Once known as Google Checkout, Google Wallet is an online payment service that allows users to send safe, simple, and speedy money transfers from their browser, smartphone, or Gmail account. You can store credit cards, debit cards, loyalty cards, and even gift cards to your account.

13. WePay

WePay prides itself on its top-notch customer service and fraud protection. Merchants, however, like the fact that customers can make their purchases without having to leave their site, thanks to a virtual terminal. WePay also offers Know Your Customer collection and risk management and can be used for invoicing, event ticketing, and marketing automation.

Related: How Square Is Helping Businesses Save on Transaction Fees

14. Intuit GoPayment

Intuit is almost indispensable for a small business owner. Besides being able to accept payments both online and in person with the mobile GoPayment credit card processor, Intuit can assist you with payroll and calculating taxes. The most promising features is the low monthly rate of $19.95, which only charges a 1.6 percent charge for credit card swipes, as opposed to the standard 2.40 percent rate.

15. Authorize.net

You can’t leave out Authorize.net. After all, it’s been processing payments since 1996! It’s also the Internet’s most widely-used payment gateway and has been the recipient of the Achievement in Customer Excellence (ACE) award from 2008 to 2016. Even though the company has been around for twenty years, it stays current with trends, like being able to accept Apple Pay. No wonder the company is so widely regarded!

Today, online businesses have more payment platform options than ever before. Each platform comes with its own advantages and fallbacks, and it’s up to you to find out which is best for your business. Which payment platforms have simplified your business transactions in the past? Which platforms do you plan on trying?

Screenshots taken on 11/15/16

Editor's note: Due is a content partner of Entrereneur.com.

Comments are closed.